Manufacturers Return to Small Industrial

Manufacturers accounted for almost a quarter of all new tenancies in smaller industrial properties in Western Sydney at the end of last year as small-scale production trends shifted.

LJ Hooker Commercial’s Sydney Industrial Market Monitor showed manufacturers accounted for 23.7% of leases signed for sub-3,000sqm properties through the city’s Central West and South West corridors in late 2023.

Australia’s manufacturing base has become more competitive as China battles labour costs, stricter environmental regulations, technological advancements, and global supply chain diversification. Combined, the global conditions have made small-scale local production more competitive in Australia.

While demand has pulled back from Covid’s unprecedented enquiry, rents are still rising faster than inflation, the report found. A-grade facilities below 3,000sqm are attracting around $250psm – a 14% increase from the start of the year.

Nonetheless, budget conscious tenants were still looking to negotiate with landlords, said LJ Hooker Group’s Head of Commercial, Tom Donnelly.

“There’s a pattern of landlords wanting to maintain face rents, so incentives have edged up over the year between 6-10%,” said Mr Donnelly.

“Business owners have been challenged by increases in fuel, utilities and insurance. While the vacancy rate is very tight, tenants are still looking to improve their bottom lines.”

According to the Monitor, the construction and wholesale trade sectors were the most prolific tenant bases (14.97% and 14.49%, respectively).

For larger warehouses, transport and logistics continues to dominate, representing 55% of leases signed over the year.

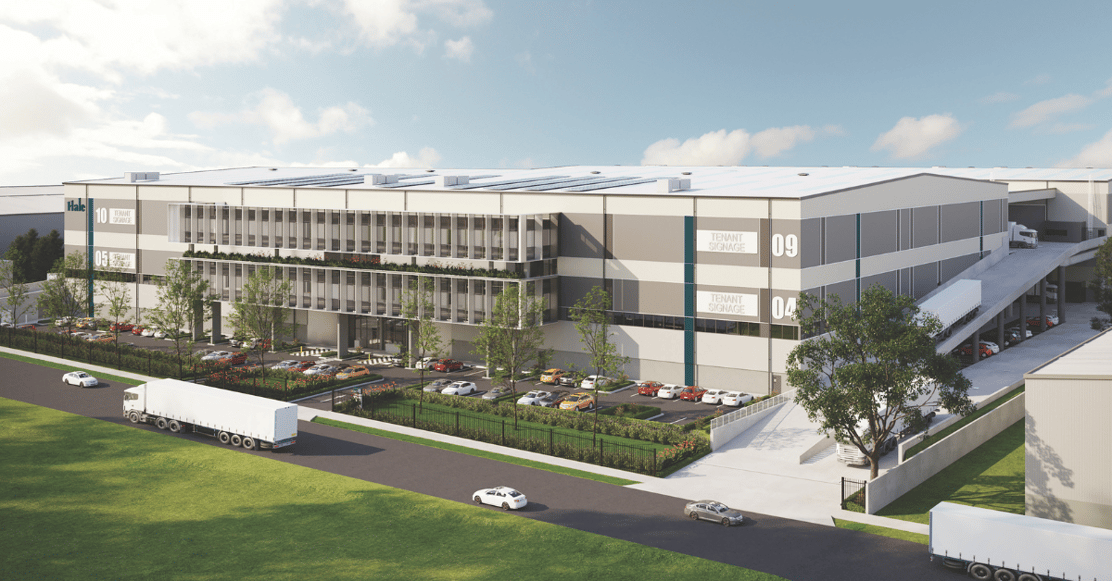

More than 200,000sqm of new supply will be completed in 2024, the Monitor predicted, including a handful of two-level warehouse developments.

“There’s simply an undersupply of greenfield and brownfield opportunities in market to meet demand,” said Mr Donnelly.

“Developers and funds have invested a lot of time researching multi-level warehousing with cutting-edge design and efficiencies to meet demand.

“While demand has pared back from Covid-levels, it remains elevated on a historical level.”

Yields softened slightly over the year by around 25 basis points, the Monitor found.

Read more: LJ Hooker Commercial Sydney Industrial Market Monitor

Share